Business debt can be a strategic tool for growth or a crippling liability if mismanaged. The capacity to discern between productive debt, such as loans that enable expansion, and burdensome debt, like high-interest credit, is fundamental. Debt itself is neither inherently good nor bad—it depends on its alignment with business goals and cash flow realities.

Evaluating the Present Debt Condition

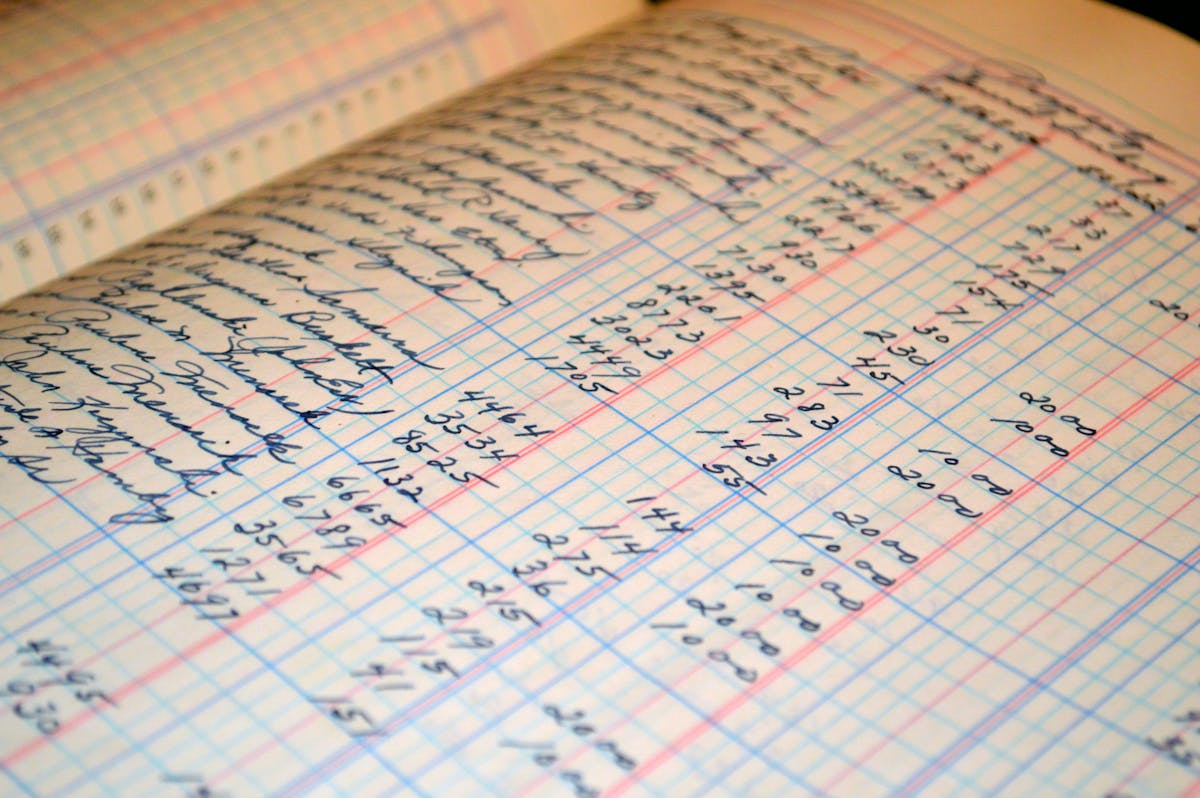

A comprehensive assessment of outstanding debt is the cornerstone of responsible management. List all financial obligations, including principal amounts, interest rates, repayment terms, and associated fees. Utilize financial software or spreadsheets to visualize monthly outflows and identify debts with the most immediate impact on cash liquidity.

For example, a retail company could realize that the interest rate on its revolving credit line exceeds that of its equipment loan, indicating an urgency to focus on repayment in that order. It is important to monitor monthly patterns in balance reduction to determine if debt levels are decreasing, remaining steady, or getting worse.

Prioritizing Debts Strategically

Both cost and risk should drive the {prioritization} process. Debts linked to variable interest rates might present increased uncertainties over the long haul, particularly in unstable economic situations. High-interest liabilities, like those from credit cards or merchant cash advances, usually intensify financial pressure. If business leaders adopt a structured plan for clearing debts—whether it be the avalanche approach (focusing on the highest interest first) or the snowball approach (tackling the smallest balance first)—they can choose a method that offers psychological and numerical benefits.

Consider the snowball method: A marketing agency has three obligations—$10,000 with 18% interest, $15,000 with 12% interest, and $20,000 with 9% interest. By tackling the 18% obligation initially, the agency lessens its interest load in the most effective way, allowing for quicker capital reinvestment.

Enhancing Cash Flow Management

Successful management of liabilities is connected with strategic cash flow methods. Encourage faster collection of accounts receivable by offering incentives like minor deductions for swift payments. Arrange extended payment schedules with suppliers to maintain liquidity in the company for extended durations. Employ cash flow projections to predict deficits and surpluses, modifying debt repayments as needed to prevent fees or missed liabilities.

A practical example: An e-commerce company schedules loan payments for the day after peak sales cycles, ensuring sufficient funds are available and minimizing the risk of overdrafts.

Refinancing and Debt Restructuring Options

Refinancing is the process of taking out a new loan to replace current debt, generally with better conditions such as reduced interest rates, longer payment periods, or both. Debt restructuring can mean reaching an agreement with creditors to modify payment timelines, lower rates, or agree to a single payment lower than the initial debt.

This method is frequently seen in industries that encounter regular economic declines. A building firm that is dealing with postponed payments on government contracts could effectively transform its short-term loan into a long-term agreement, maintaining its working capital during tough times.

Balancing Growth with Debt Obligations

Responsible debt management involves finding a balance between repayment strategies and growth investments. Steer clear of the mistake of utilizing one loan to repay another without a well-defined business objective. Rather, allocate debt specifically for activities that generate income: such as funding inventory ahead of peak seasons, enhancing technology to boost efficiency, or venturing into new markets with proven demand.

A case in point: A software-as-a-service startup leverages a low-interest Small Business Administration (SBA) loan to hire additional developers, releasing a new feature set that accelerates customer acquisition, thereby justifying the debt as a catalyst for sustainable growth.

Looking for Expert Guidance and Assistance

Accountants, financial advisors, and business mentors are able to provide impartial perspectives on debt management approaches. They supply benchmarking data, determine the tax effects of interest payments, and highlight government initiatives aimed at reducing small business debt, like stabilization loans during sector-wide difficulties.

Financial counseling is particularly useful when preparing for investor scrutiny or preparing documentation for refinancing, ensuring that all liabilities are accurately represented and managed.

Keeping Alert and Flexible

Consistent observation and re-evaluation are essential. Schedule reviews every three months to assess the extent of liabilities, reconsider repayment goals, and modify approaches based on changes in market situations or regulatory settings. Utilize online dashboards to consolidate financial information and set up notifications for any upcoming dues or irregularities in cash flow.

Resilience in managing debt hinges on proactive strategy, informed examination, and a steadfast adherence to financial discipline. The balance between quick liquidity remedies and comprehensive financial strategy determines if debt stays a manageable asset or becomes a hurdle in the advancement of the organization. Insightful leaders who tirelessly enhance their methods discover that debt, when used wisely, can function not only as a survival mechanism but also as a springboard for transformative development.